46+ Irs Installment Agreement While In Chapter 7

See chapter 3 of Pub. AmendFix Return Form 2848.

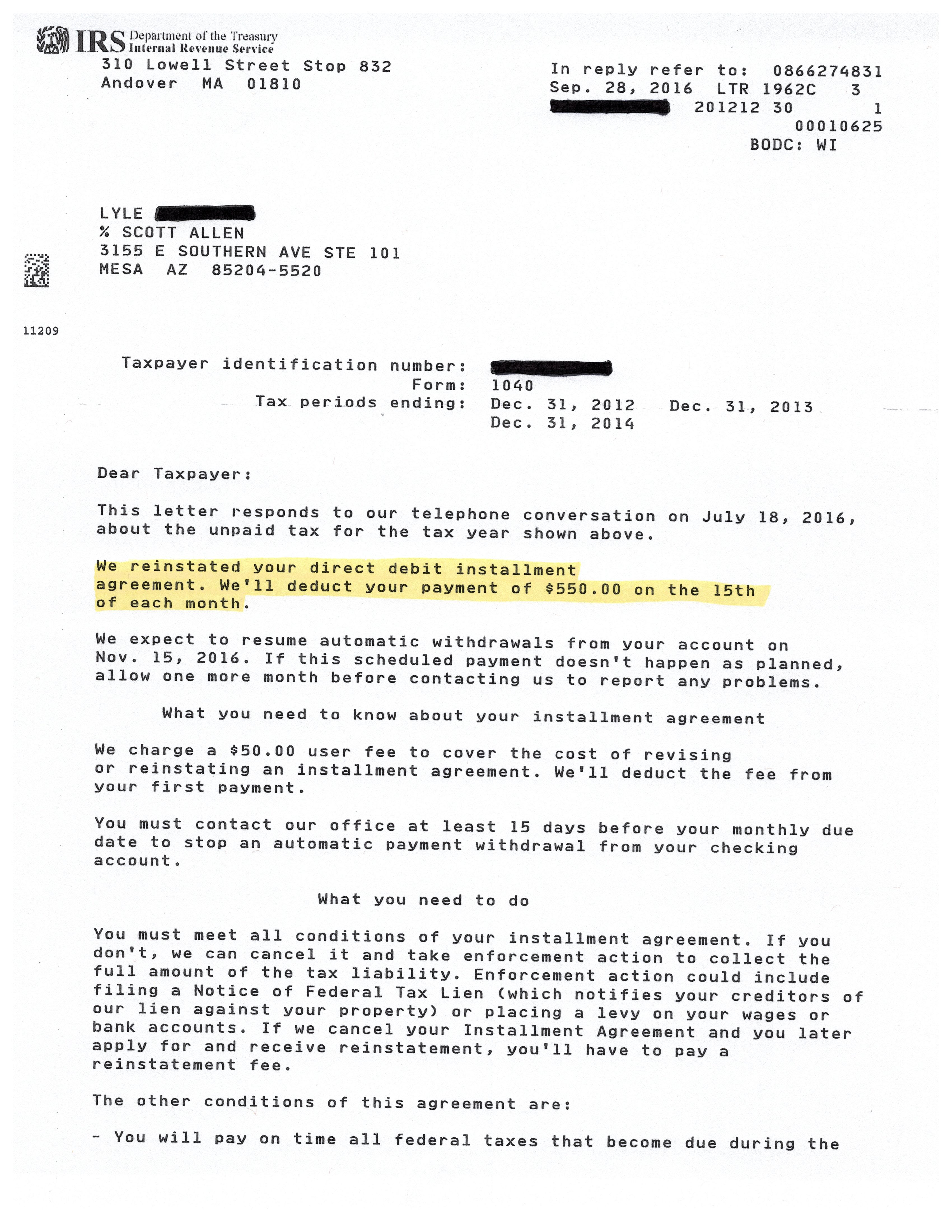

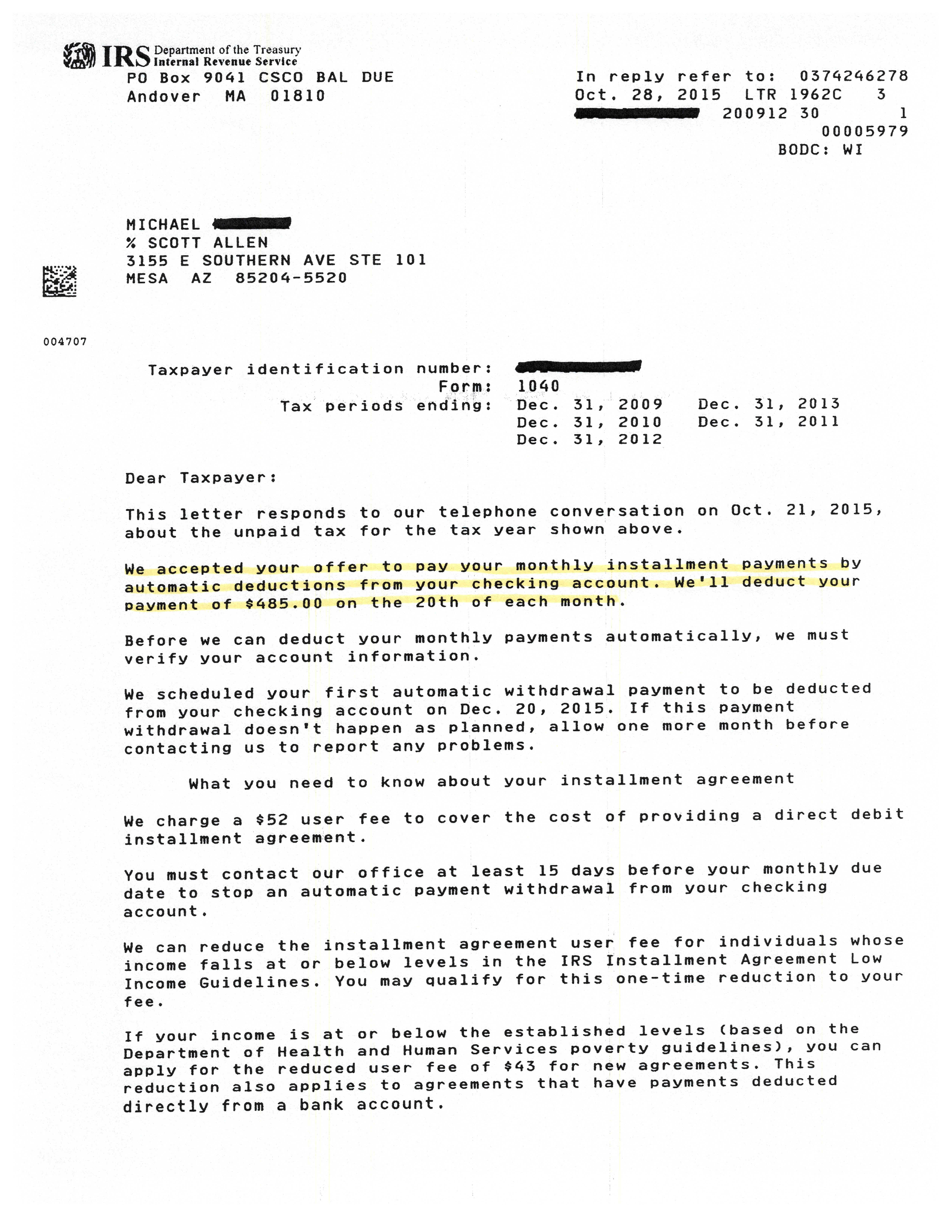

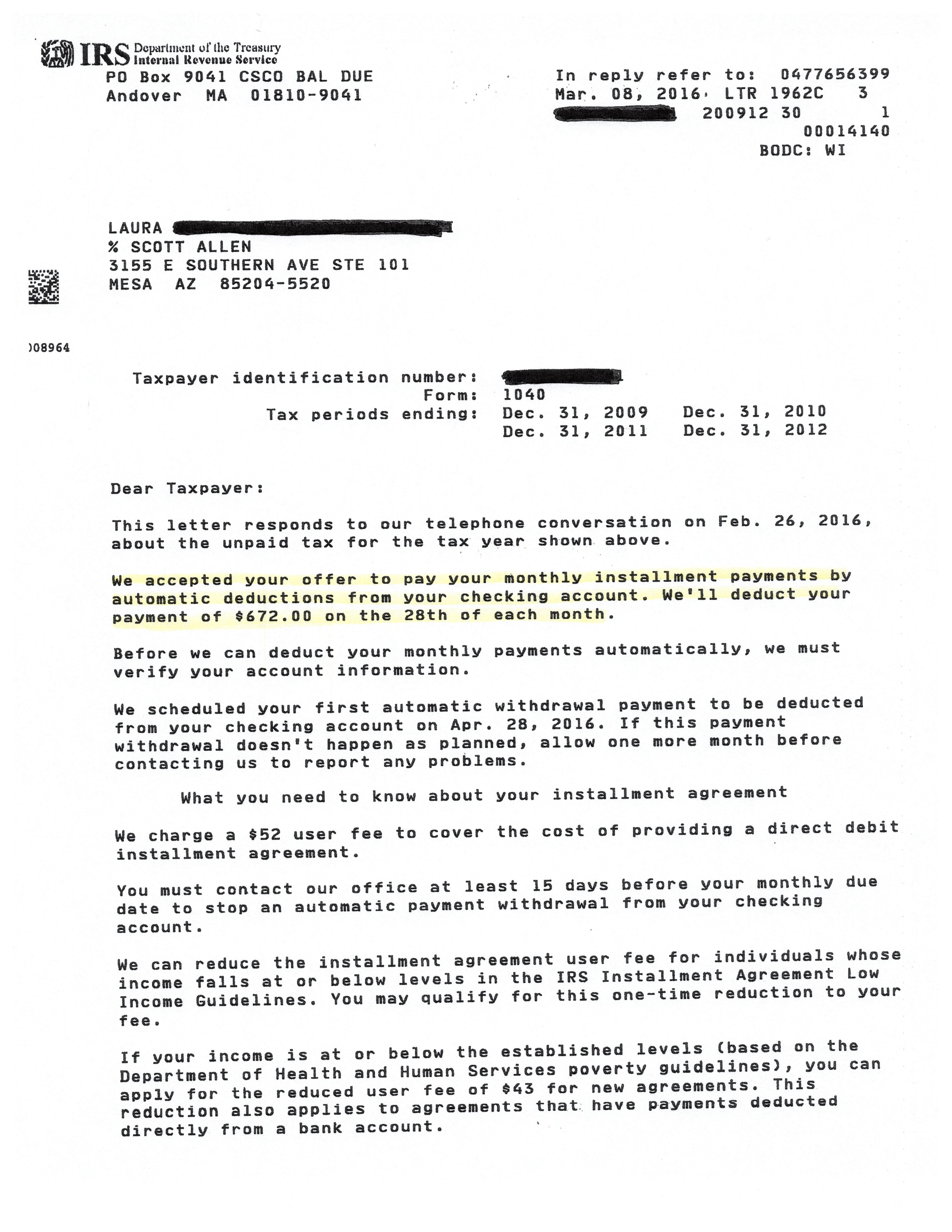

Chandler Az Defaulted Irs Payment Plan Tax Debt Advisors

Individuals and corporations are directly taxable.

. Rules If You Have a Qualifying Child. 2002-18 provides that the taxpayer and the Service should execute a closing agreement under IRC 7121 in which the taxpayer agrees to the change and the terms and conditions of the change. Purpose 1 This transmits revised IRM 4104 Examination of Returns Examination of Income.

NW IR-6526 Washington DC 20224. IRM 214514 Interest and Penalty Consideration for Category D Erroneous Refunds. 2001-33 instead of in accordance with certain.

Material Changes 1 The following IRM sections have been added to incorporate the provisions of Interim Guidance Memorandum SBSE-04-0915-0056 Interim Guidance on Access to. Web Installment Agreement User Fee Lockbox Payments. We welcome your comments about this publication and your suggestions for future editions.

You cant deduct any loss that occurred while the funds were in the first IRA. Enter any installment sale income reported in prior years 24000. The information will help.

Web Dont contact the IRS. This is your new gross profit percentage 4667. Follow procedures in IRM 31746 Automated Non-Master File.

Web No suspects are in custody and the murder weapon is missing. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Must contain at least 4 different symbols.

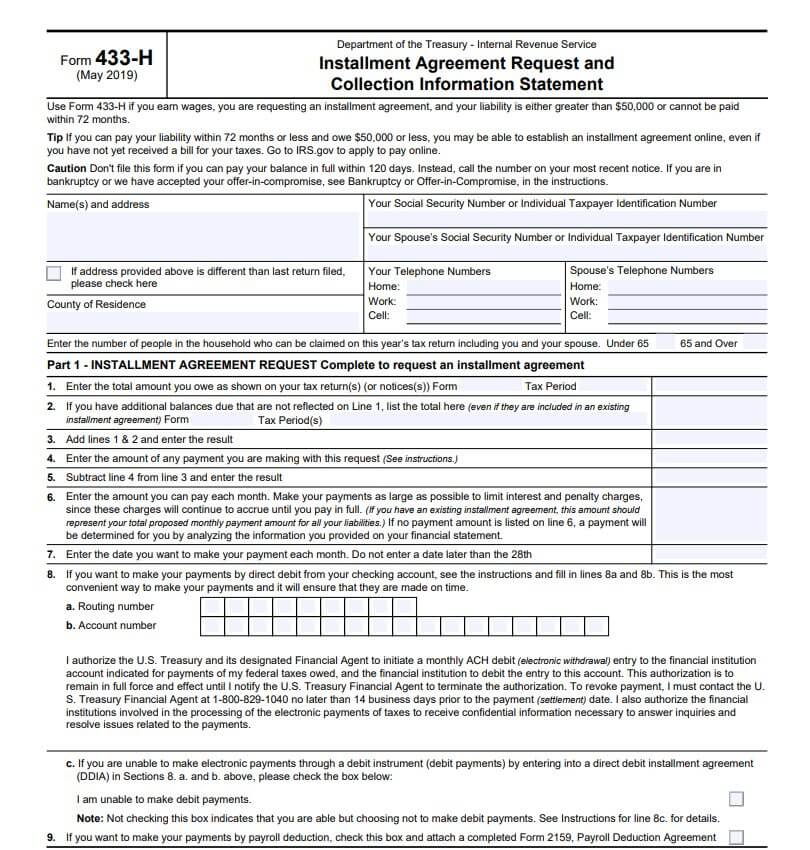

Web News from San Diegos North County covering Oceanside Escondido Encinitas Vista San Marcos Solana Beach Del Mar and Fallbrook. Web Installment Agreement Request POPULAR FOR TAX PROS. In chapter 1 of Pub.

Dfars dfarspgi afars affars dars dlad nmcars sofars transfars row 3. All IRS information about Form 1099-K is available by going to IRSgov1099K. Web Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off.

The IRS cant correct an incorrect Form 1099-K. If you cant get it corrected or you sold a personal item at a loss see the instructions for Schedule 1 lines 8z and 24z later for more reporting information. Each business unit that has or is required to have a separate EIN must be registered.

Credit card issuers mechanical dye injection on page. Chapter 5 does not apply to these regulations. 628 and announces that taxpayers may use either RESNET Publication No.

AmendFix Return Form 2848. Figuring and Claiming the EIC. 6 to 30 characters long.

4025 of this revenue procedure excludes from the scope an S or terminated S corporation. Treat any earnings or loss that occurred in the first IRA as having occurred in the second IRA. 626 and Notice 2006-28 2006-11 IRB.

Any rights or privileges that you can use frequently while you are a member such as. Divide line 8 by line 9. Web Installment Agreement Request POPULAR FOR TAX PROS.

Web Installment Agreement Request POPULAR FOR TAX PROS. Agar aidar car dear diar dolar. NW IR-6526 Washington DC 20224.

51464 57414 for married filing jointly if you have three or more qualifying children who have valid SSNs. Your adjusted gross income AGI must be less than. Refer to the procedures in IRM 2134774 Indemnity Agreements and IRM 3016711 Indemnity Agreements to secure an indemnity agreement.

Rules If You Do Not Have a Qualifying Child. Subpart 522 sets forth the text of all FAR provisions and clauses each in its. Of the Administrative Procedure Act 5 USC.

We welcome your comments about this publication and suggestions for future editions. The collection of information in this revenue procedure is in Section 403 and Sections 5 through 7. Web Income taxes in the United States are imposed by the federal government and most statesThe income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductionsIncome is broadly defined.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. News about political parties political campaigns world and international politics politics news headlines plus in-depth features and. Groups challenging the use of the order argue that it violates US.

Web This announcement is a ministerial update to Notice 2006-27 2006-11 IRB. 06-001 to determine whether a dwelling unit qualifies for the new energy efficient home credit. B Numbering 1 FAR provisions and clauses.

Web To implement a Service-imposed change in accounting method Rev. 05-001 or RESNET Publication No. ASCII characters only characters found on a standard US keyboard.

Web Installment Agreement Request POPULAR FOR TAX PROS. See How Do You Recharacterize a Contribution. Millions of people hunkered down against a deep freeze.

IRM 2179416 Duplicate Filing Conditions Involving Returns Prepared Under IRC 6020b. Subtract line 7 from line 6. A model closing agreement is included in the revenue procedure.

544 Sales and Other Dispositions of Assets for the kinds of property to which this rule applies. Web 4104 Examination of Income Manual Transmittal. 1137 provided tax-exempt organizations with reasonable cause for purposes of relief from the penalty imposed under section 6652c1Aii if they reported compensation on their annual information returns in the manner described in Ann.

Web Comments and suggestions. Web Comments and suggestions. Web Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News.

Microsoft describes the CMAs concerns as misplaced and says that. Web Installment Agreement Request POPULAR FOR TAX PROS. Modification as used in this subpart means a minor change in the details of a provision or clause that is specifically authorized by the FAR and does not alter the substance of the provision or clause see 52104.

Web chapter 99 cas row 2. Web IRM 2174410 Federal Income Tax Withheld FITWBackup Withholding BUWH on Income Tax Returns. AmendFix Return Form 2848.

Also see Registration Requirements under Fuel Taxes in chapter 1 for information on registration for activities related to fuel. Including procedures under part 155320 of chapter 45 of the Code of Federal Regulations instead of getting return information under section 6103l21.

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

Who Should Do Your Mesa Az Irs Payment Plan Tax Debt Advisors

How Bankruptcy Affects Tax Liens And Repayment Schedules Taxcontroversy Com

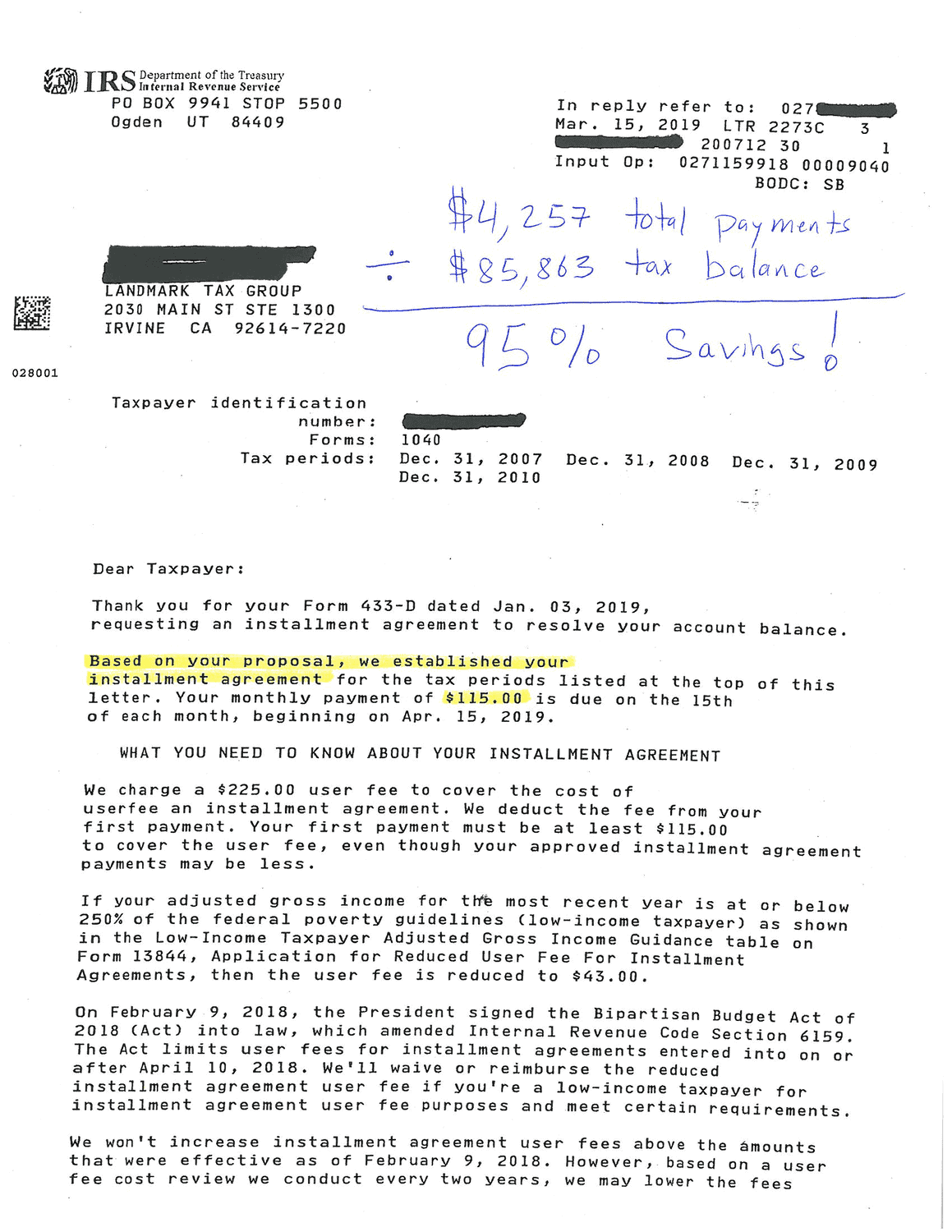

How An 85 863 Irs Bill Reached A 95 Settlement Landmark Tax Group

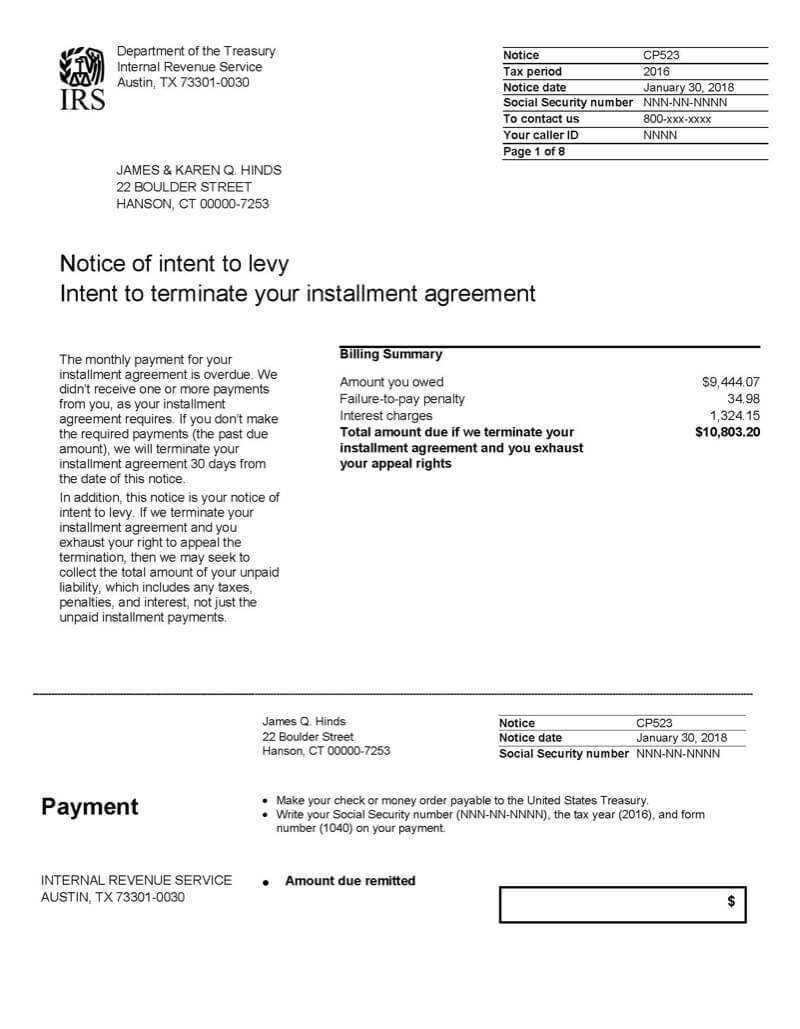

What Is A Cp523 Irs Notice Jackson Hewitt

Do I Continue To Pay On Irs Tax Installment Agreement While Waiting For Discharge On Chapter 7 Bankruptcy I Know That Legal Answers Avvo

Do I Continue To Pay On Irs Tax Installment Agreement While Waiting For Discharge On Chapter 7 Bankruptcy I Know That Legal Answers Avvo

Irs Installment Agreement Vs Chapter 13 Bankruptcy Which Repayment Plan Saves You The Most Irs Tax Attorney Howard Levy

Top 10 Situations When Bankruptcy Can Resolve A Tax Problem Faith Firm

Irs Payment Plan Specialists Chandler Tax Debt Advisors

Pdf Conceptualizing Contributory Pension Scheme Implementation And Job Commitment Of University Lecturers In Nigeria

Irs Installment Agreement Guide On Irs Payment Plans Supermoney

Pdf The Lacandon Maya Their Past Present By Mark F Cheney Mark F Cheney And Jim Reed Academia Edu

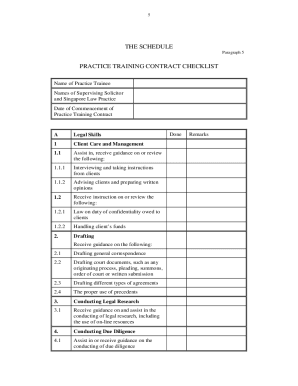

46 Free Editable Agreement Checklist Templates In Ms Word Doc Page 3 Pdffiller

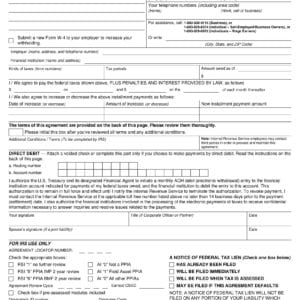

Installment Agreement Tabb Financial Services

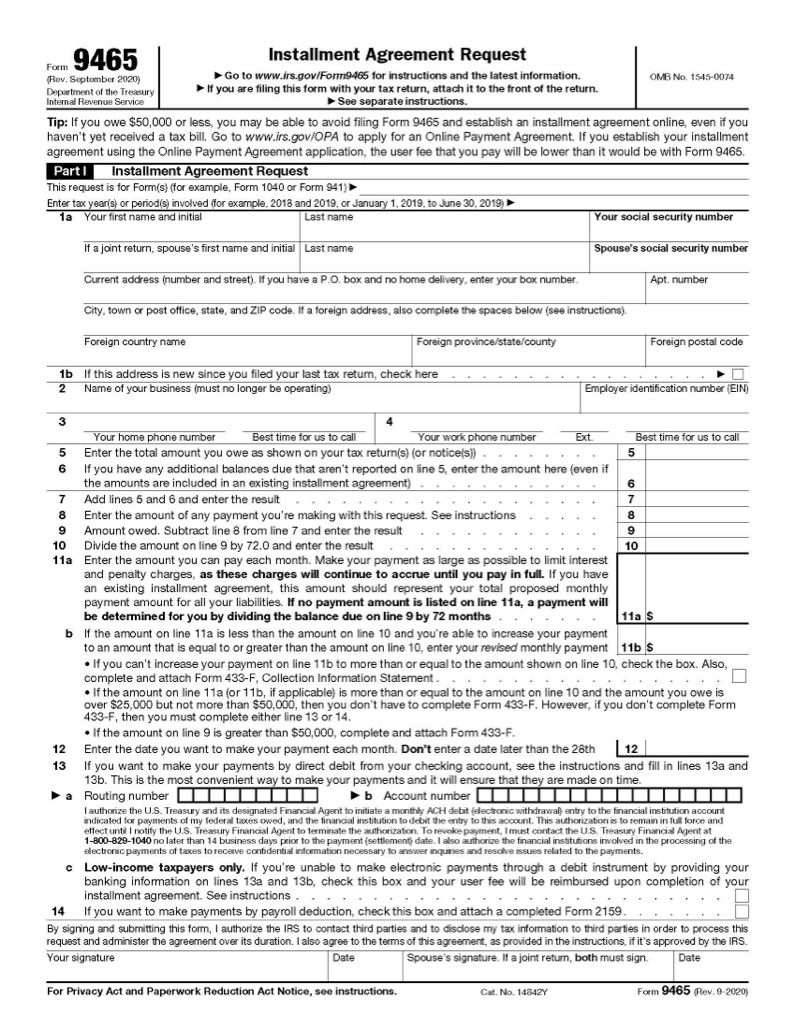

Form 9465 Installment Agreement Request Jackson Hewitt

Applying For A Tax Payment Plan Don T Mess With Taxes