Conventional fixed rate mortgage calculator

A conventional mortgage or conventional loan is any type of homebuyers loan that is not offered or secured by a government entity like the Federal Housing. Conventional 30 year fixed.

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

By default 250000 30-yr fixed-rate loans are displayed in the table below.

. Because its a fixed-rate mortgage FRM it maintains the same interest rate for the entire loan duration. 30-year fixed-rate mortgage lower your monthly payment. This can be changed as needed.

Mortgage Rate APR Change. Your monthly payment stays the same for the entire loan term. To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page.

More flexible qualification guidelines than conventional loans. Therefore the rate and payment results you see from this calculator may not reflect your actual situation. 5266 53 -024.

Some mortgage programs such as the conventional. No interest rate surprises. Refinancing from a 30-fixed FHA loan to a 15-year fixed-rate conventional loan eliminates MIP and helps slash interest charges.

You should adjust the default values of the mortgage calculator including mortgage rate and length of loan to reflect your current situation. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals. 6173 6205 013.

Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. The lowest fixed rate. You can generate a similar printable table using the above calculator by clicking on the Inline.

They are also available in adjustable-rate options. We provide the average conforming 30-year fixed-rate mortgage FRM interest rate as a starting point. Conventional Mortgages and Loans.

The interest rate is the main factor used by the mortgage payment calculator to determine what your monthly payment and costs will be over time. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

Average rates for a 30-year fixed-rate mortgage surged as high as 581 in late June but have since leveled off at 555 as of August 25 according to Freddie Mac. Conventional loans can come with a fixed or adjustable rate and they can be conforming meaning they fall within the loan limits set by the Federal Housing Finance Agency FHFA or non. Conventional mortgages may offer a lower interest rate and Annual Percentage Rate APR than other types of fixed-rate loans.

Lock-in Redmonds Low 30-Year Mortgage Rates Today. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI.

Resources and tools. Filters enable you to change the loan amount duration or loan type. Refinance to a fixed-rate mortgage.

The loans interest rate. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgages. But borrowers can also take 10-year 20-year and 25-year terms.

Conventional rate-and-term refinance. Thats still nearly double. Depending on your financial situation one term may be better for you than the other.

Use this mortgage calculator to estimate your monthly payment for various properties. A 10-year fixed mortgage is a home loan thats paid within a period of 10 years. Conventional 30 year fixed.

With a fixed-rate mortgage or a conventional loan the interest rate wont change for the life of your loan protecting you from the possibility of rising interest rates. Well also compare payments between 10-year 15-year and 30-year fixed-rate mortgages. Across the United States 88 of home buyers finance their purchases with a mortgage.

Conventional loans are commonly offered in 15 and 30-year fixed rate loans. Explore the benefits of getting a 30-year fixed and apply today. How much money could you save.

Conventional 15 year fixed. Mortgage has developed the first ever. We offer a wide range of loan options beyond the scope of this calculator which is designed to provide results for the most popular loan scenarios.

The other knock about going the route of the Reverse Mortgage over the Conventional loan in some peoples opinions is that Reverse Mortgages are too expensive. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. 30-Year Fixed Mortgage Get a fixed interest rate and lower monthly payments.

Understanding How 10-Year Fixed Mortgages Work. The 30-year fixed mortgage is a great way to buy or refinance a home. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

Conventional 15 year fixed.

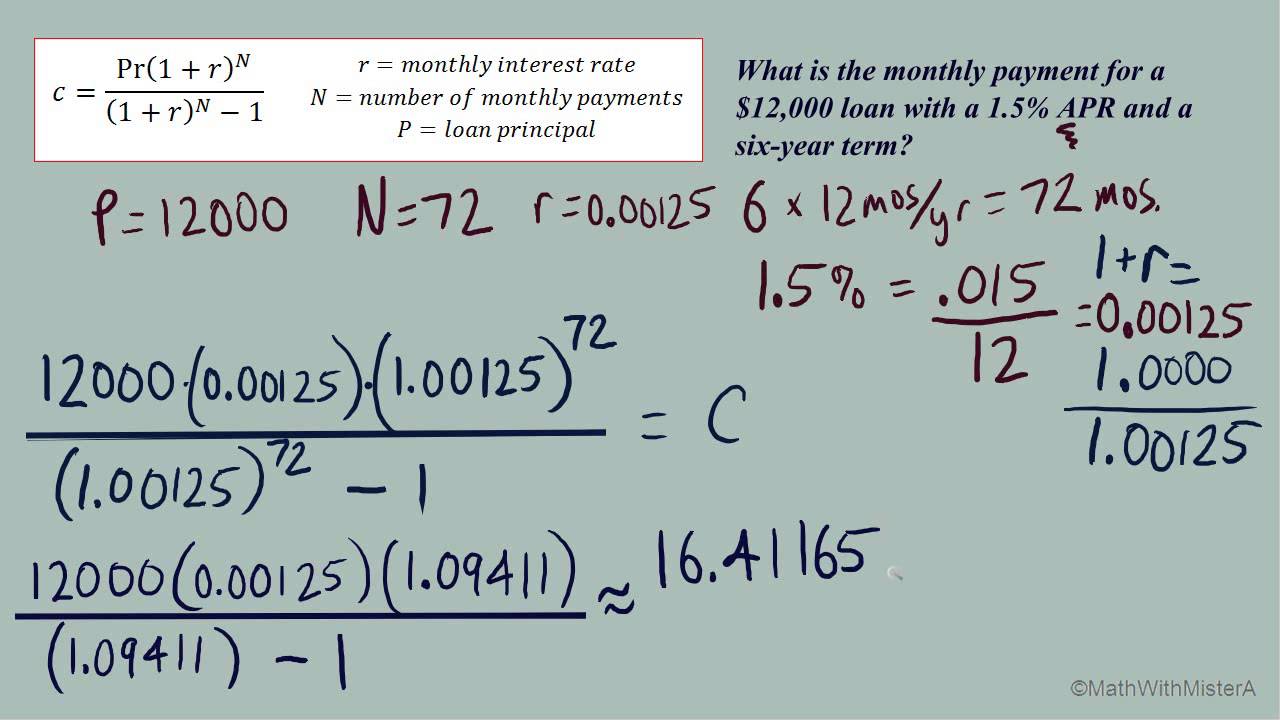

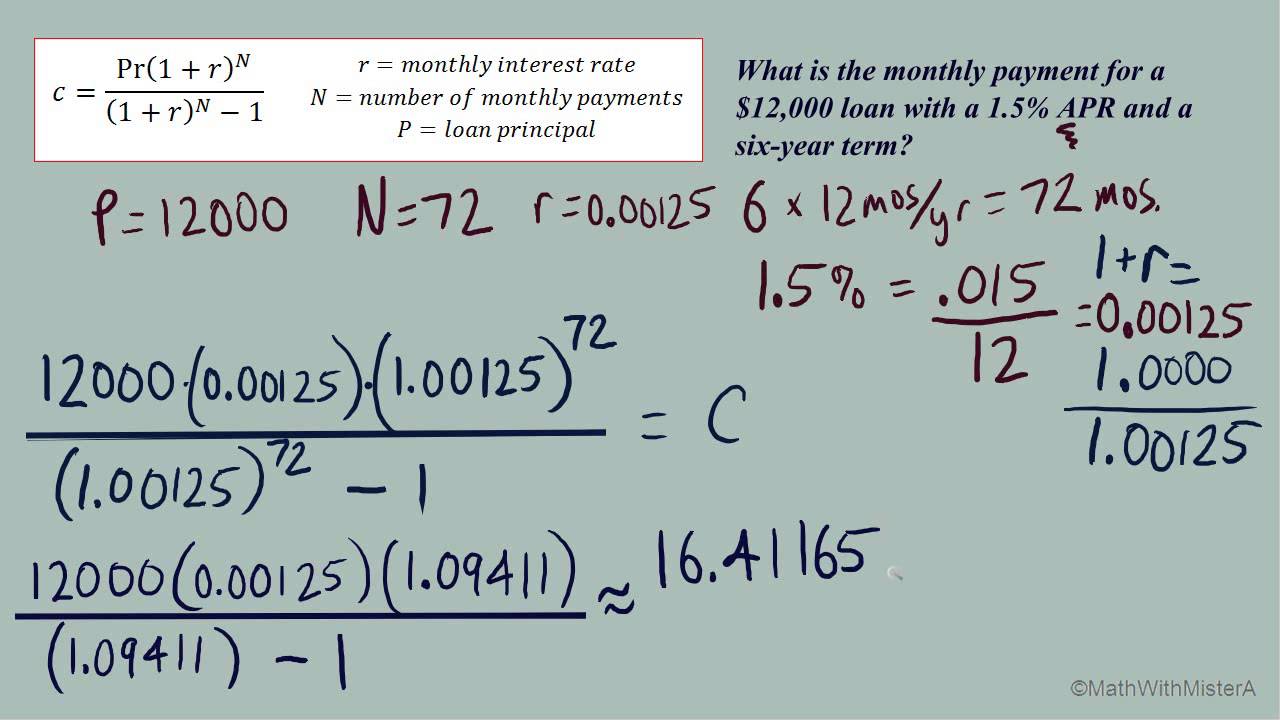

Mortgage Calculator How Much Monthly Payments Will Cost

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Fixed Rate Vs Adjustable Rate Mortgages

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

5 Year Fixed Mortgage Rates And Loan Programs

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Mortgage Calculator Youtube

Mortgage Calculator Money

Va Mortgage Calculator Calculate Va Loan Payments

/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Fixed Rate Vs Adjustable Rate Mortgages

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator How Much Monthly Payments Will Cost

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Infographic Mortgage Loan Originator